tax refund on lv bags in australia | how much is vat refund uk tax refund on lv bags in australia Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to . Find the perfect beachfront home rental for your trip to Marsaskala. Pet-friendly beachfront home rentals, beachfront home rentals with a pool, private beachfront home rentals and .

0 · what is the bag tax refund

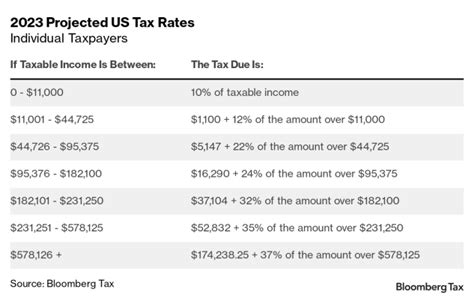

1 · tax deduction for bags Australia

2 · how much is vat refund uk

3 · does the bag offer a refund

4 · australian taxation office bags

5 · australian tax office baggage claim

6 · australian tax office baggage

7 · australian tax office bag deduction

Air Malta ceased flight operations on March 30th, 2024. We extend our heartfelt thanks to our dedicated employees for their unwavering commitment and hard work over our. 50 year tenure. We also express our gratitude to all our loyal customers, travel partners, and collaborators for their support throughout the years. Since the first Boeing 720B .

Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme . If the bag or case costs under 0, you can claim the deduction immediately on your tax return. To make a claim, you'll need to satisfy four tests: Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to .

you have to apply for the tax refund, but the price of the bags are also generally cheaper (presumably because no extra tariffs are stuff for European bags in Europe).

It means that if you buy 0 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total 0 USD worth of goods from Louis Vuitton, .International travellers (including Australians) might be able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia that you . You can claim a GST refund in Australia by lodging a TRS claim through Mobile or Applications. After filling out the claim, you will receive an auto-generated QR code. You still need to present your goods, passport, .

Can I write off a Louis Vuitton bag? The basic rule for claiming a handbag or briefcase as a tax deduction is that it must .How to claim a refund. Purchased goods have been made within 60 days of departure. Your purchases is AU0.00 (inc. GST) or more in one store. As the travelling passenger, you . You must leave China from an approved port within 90 days of purchase to receive a refund. Australia. How Much: 10%. Who: Both visitors to and residents of Australia who are leaving the country. Which Stores: Stores require no particular designation from the government in order to sell to customers who will request tax refunds on the goods. Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on .

If the bag or case costs under 0, you can claim the deduction immediately on your tax return. To make a claim, you'll need to satisfy four tests:

what is the bag tax refund

Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to claim bags, cases and luggage. Types of bags and cases you can claim.you have to apply for the tax refund, but the price of the bags are also generally cheaper (presumably because no extra tariffs are stuff for European bags in Europe).

light nylon prada socks dupe

It means that if you buy 0 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total 0 USD worth of goods from Louis Vuitton, at one or more of their stores, you can apply for GST refund.International travellers (including Australians) might be able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia that you then take out of the country with you on a plane or ship. You can claim a GST refund in Australia by lodging a TRS claim through Mobile or Applications. After filling out the claim, you will receive an auto-generated QR code. You still need to present your goods, passport, boarding pass, original tax invoices, and the QR code to the TRS Facility.

Can I write off a Louis Vuitton bag? The basic rule for claiming a handbag or briefcase as a tax deduction is that it must be directly connected with producing your income. You can generally claim your handbag or briefcase as a tax deduction if .How to claim a refund. Purchased goods have been made within 60 days of departure. Your purchases is AU0.00 (inc. GST) or more in one store. As the travelling passenger, you have paid for the goods. Present an original copy of the tax invoice to the ABF officers. You must leave China from an approved port within 90 days of purchase to receive a refund. Australia. How Much: 10%. Who: Both visitors to and residents of Australia who are leaving the country. Which Stores: Stores require no particular designation from the government in order to sell to customers who will request tax refunds on the goods.

tax deduction for bags Australia

Want to put hundreds of dollars back in to your wallet or purse ahead of your next flight out of Australia? Here’s how to take advantage of the country’s Tourist Refund Scheme or TRS, which lets you claim back the 10% GST sales tax imposed on . If the bag or case costs under 0, you can claim the deduction immediately on your tax return. To make a claim, you'll need to satisfy four tests:

Bags and cases for work items. Deductions for bags, cases, luggage, lunch boxes and travel mugs you use for work. Last updated 24 June 2024. Print or Download. Eligibility to claim bags, cases and luggage. Types of bags and cases you can claim.you have to apply for the tax refund, but the price of the bags are also generally cheaper (presumably because no extra tariffs are stuff for European bags in Europe).

It means that if you buy 0 AUD worth of goods from Louis Vuitton, you will not be eligible for GST refund. But if you buy in total 0 USD worth of goods from Louis Vuitton, at one or more of their stores, you can apply for GST refund.

International travellers (including Australians) might be able to claim a GST (Goods and Services Tax) and WET (Wine Equalisation Tax) refund for some goods bought in Australia that you then take out of the country with you on a plane or ship. You can claim a GST refund in Australia by lodging a TRS claim through Mobile or Applications. After filling out the claim, you will receive an auto-generated QR code. You still need to present your goods, passport, boarding pass, original tax invoices, and the QR code to the TRS Facility.

Can I write off a Louis Vuitton bag? The basic rule for claiming a handbag or briefcase as a tax deduction is that it must be directly connected with producing your income. You can generally claim your handbag or briefcase as a tax deduction if .

how much is vat refund uk

linkedin sales assistant prada galleria cavour diego

made in romania prada

May 28, 2024 - Entire home for $359. This upstairs apartment is reached through entrance into the original home's front hallway. The hallway is shared by both apartments. At the .

tax refund on lv bags in australia|how much is vat refund uk